Oil prices are on course for their largest annual slide since 2008, capping

another dire year for commodities, as crude fell again on Tuesday to hover at

close to half its level of six months ago.

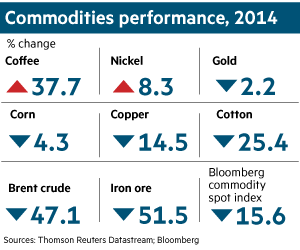

Brent’s 49 per cent plummet since June — alongside a near halving of iron

ore prices and sharp drops in coal and copper — has also helped drag the

Bloomberg Commodity index down 15.6 per cent in 2014 to a five-year low.

While the international benchmark’s price plunge could prove a significant

boon for the global economy, it has thrown big oil exporters such as Russia and

Venezuela into disarray, and forced oil companies to re-examine their

investment plans and look for ways to reduce costs.

In a sign of how the oil majors are scrambling to make savings, BP, Royal

Dutch Shell, Total and Chevron have all ordered sharp cuts in the rates paid to

skilled contractors on projects in the UK North Sea.

The groups are cutting up to 15 per cent of the pay of thousands of

self-employed oil and gas workers in the region. US-based Chevron told

employment agencies that it would reduce rates from January 1 "to better align

with industry benchmarks and manage cost pressures”, while BP has decided to

cut the wages of 450 workers by up to 15 per cent from the new year. It said it

remained "firmly committed” to the North Sea, but added that "costs have been

rising and we must respond to these toughening market conditions”.

Another oil major is cutting UK contractor rates by 10 per cent. Shell has

reduced rates in recent weeks, and oil services company Wood Group has

announced pay cuts for 1,300 contractors.

A senior oil executive said that the drop in crude was "an opportunity” to

lower exploration costs globally by renegotiating contracts with providers such

as drilling companies. "Exploration is the easiest activity to reduce,” he

said.

The cuts in contractors’ pay have raised fears that job losses will soon

follow if crude fails to recover. Unite, the British union, said that the oil

majors’ actions would "cascade” through the industry and urged them to resist

"short-term measures”.

Recruitment group Hays confirmed that the falling oil price had led to pay

cuts for contractors. Its most recent annual pay survey showed that average

wages for North Sea workers were $94,200 in 2013, up from $87,100 in 2012.

"Although some companies have opted to make the rate cuts almost immediately,

others are adopting a ‘wait and see’ approach,” said Ed Allnutt, director of

Hays Oil & Gas.

Industry analysts believe the North Sea will be targeted as energy groups

curb spending on development. Though investment in new projects recently hit

record levels, leading to several years of inflation-beating pay increases, UK

oil and gas output has declined and exploration has been poor. Soaring costs

and a complicated tax system have made smaller, more mature fields a riskier

bet.

Analysts say there are few signs the sell-off — due to a combination of

rising supplies of high-quality oil from the US and weak demand in Europe and

Asia — has ended. Fears of a large supply glut in the first half of 2015

outweigh lower production from countries such as Libya, where an expanding civil

conflict has dented output. On Tuesday Brent fell to a new five-year low of

less than $57 a barrel before recovering slightly to $57.31.

In the past, Opec, which pumps more than a third of the world’s oil, has

cut output in response to lower prices, such as during the 2008 financial

crisis. But at the cartel’s meeting in Vienna last month, members held output

steady at 30m barrels a day, sending prices into a tailspin.

Saudi Arabia, the cartel’s de facto leader, has said it will not cut

production irrespective of price levels "be it $40, $30 or $20 per barrel”, a

policy shift that will have far-reaching implications for the global energy

industry.

"Saudi Arabia’s unprecedented move has sown the seeds of uncertainty about

oil prices and is likely to make oil companies question every single

capital-intensive project, which are the bulk of today’s oil output,” said

Amrita Sen of Energy Aspects, a consultancy.

Analysts say that Saudi Arabia and its Gulf allies wants to challenge high-cost

sources of production — from the oil sands of Canada and US shale to deepwater

Brazil and the Arctic — that have been encroaching on Opec’s market share.

(Financial Times)