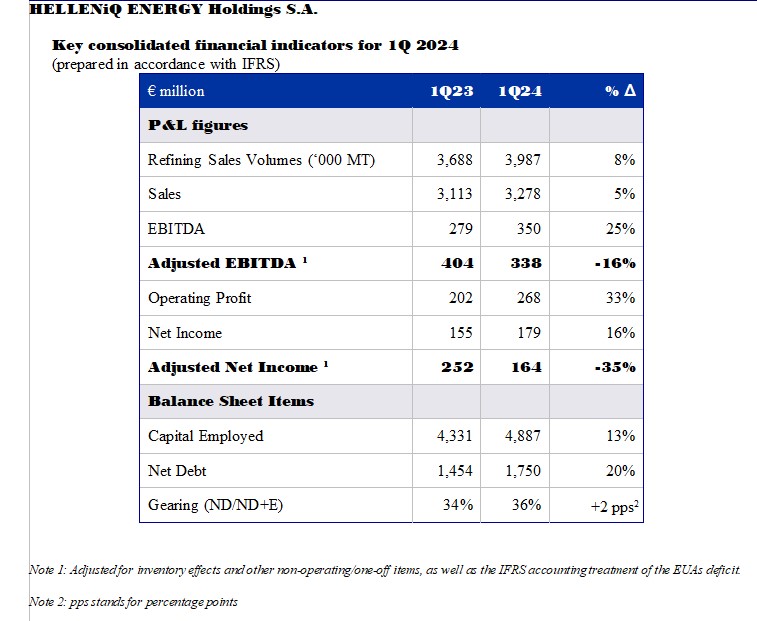

HELLENiQ ENERGY Holdings S.A. ("Company") announced its 1Q24 financial results, with Adjusted EBITDA amounting to €338m and Adjusted Net Income coming in at €164m.

1Q24 Reported EBITDA stood at €350m, with Reported Net Income amounting to €179m, higher y-o-y, mainly due to the impact of international prices on inventory valuation.

The results were primarily shaped by the favorable international refining environment, the improved operation of our refineries, with increased units’ availability, the particularly strong exports, reaching a 3-year historical high, and the improved contribution from the petrochemicals and RES businesses.

Downstream production in 1Q24 increased by 5% y-o-y to 3.8m MT, the highest since 1Q20. This performance led to increased sales volume across all markets, reaching 4m MT (+8% y-o-y), with exports accounting for 62% of total.

Strategy implementation – Vision 2025

During 1Q24, the Group continued to implement its strategy across all operations, undertaking initiatives that are expected to strengthen our profitability in the medium term, while improving our environmental footprint.

In our core business, we focus on operational excellence, as well as emissions reduction, with projects that contribute to energy autonomy and efficiency and the implementation of Carbon Capture, Utilization and Storage (CCUS) technologies. At the same time, the expansion of the polypropylene production plant is also in progress. In terms of the development of alternative fuels with a low carbon footprint, a Hydrotreated Vegetable Oil (HVO) co-processing unit is being developed and at the same time, we are assessing potential investments in the production of Sustainable Aviation Fuel (SAF), green hydrogen, and synthetic fuels.

In Fuels Marketing, our objective is to improve offered services by leveraging our extensive network and technology. We are focusing on rationalizing the domestic market network, increasing the share of company-operated petrol stations, as well as strategically expanding our international footprint. At the same time, we work on improving our sales mix, with an increased contribution from premium products and non-fuel sales, which has already yielded tangible results.

The commencement of commercial operations by EKO Energy in Cyprus earlier this year, has further enhanced the Group's successful presence in the country. EKO Energy aspires to cater to the energy requirements of eligible commercial and industrial consumers, serving as the first fully integrated and vertically aligned energy provider in Cyprus. EKO Energy leverages on EKO Cyprus’ leading position in the fuel market, facilitated by its extensive retail network and allowing for an extended product portfolio, incorporating electricity generation from RES. The total capacity of the Group's operational RES projects in Cyprus currently accounts for c.15% of PVs participating in the local electricity market, with expectations for further growth in the coming years.

In our RES business, HELLENiQ RENEWABLES has been actively expanding its portfolio, reaching a total installed capacity of 381 MW by the end of 1Q24. Furthermore, there are currently 0.7 GW of projects under construction or in advanced development stages. It is worth noting that the overall portfolio of projects under development amounts to 4.3 GW. The Company’s objective is to operate RES projects with a capacity of over 1 GW by 2025 and more than 2 GW by 2030.

In the E&P business, the processing of 3D seismic data in offshore areas, specifically the "Ionian", "Block 2" and "Block 10" areas, has been successfully concluded. Additionally, the processing of 2D seismic data in two offshore areas in Crete has been completed, while their interpretation is in progress. In the "Southwest of Crete" offshore area, a 3D seismic acquisition has also been completed, followed by data processing and interpretation.

Slightly higher crude oil prices – Reduced benchmark refining margins

Crude oil (Brent) prices in 1Q24 were slightly higher y-o-y, at $83/bbl. Accordingly, Euro strengthened slightly against the US dollar, averaging 1.09 vs 1.07 in 1Q23.

In 1Q24, natural gas and electricity prices continued to decline, by around 50% y-o-y. Accordingly, EUAs recorded a decrease of 31%, on average, compared to the corresponding period last year.

Refining margins declined from the particularly high levels of 1Q23, but remained higher than the most recent five-year cycle (2015-2019), prior to the pandemic. Our refineries' system benchmark margin averaged $8.8/bbl in 1Q24, compared to $10.6/bbl in 1Q23.

Increased demand in the domestic market

Domestic market demand reached 1.6m MT in 1Q24, +2% y-o-y, driven by a +4% y-o-y increase in the automotive fuel consumption. Aviation and marine fuel demand increased by 19% and 9% y-o-y respectively.

Balance sheet and capital expenditure

Operating cash flows in 1Q24 amounted to €83m, despite the repayment of the last installments of the solidarity contribution. Additionally, there was a temporary working capital increase, due to the disruption in trade flows in the Middle East, as a result of the ongoing geopolitical events in the Red Sea. Capital expenditure amounted to €93m, primarily directed to refinery maintenance and RES capacity expansion.

Net Debt stood at €1.75bn, slightly up q-o-q, with Gearing (Net Debt to Capital Employed) unchanged, at 36%.

In addition, bank loan refinancing amounting to €1bn is expected to be completed in the coming weeks, improving commercial terms and interest cost, and reducing dependence on base interest rates volatility. Additionally, the refinancing will extend the overall maturity profile by one year. The Group is currently considering its options around the €600m Eurobond, which matures in October 2024.

Andreas Shiamishis, Group CEO, commented on the results:

"2024 started on a positive note, reporting strong financial performance, with improved refinery products sales (+8%) and Adj. EBITDA profitability of €338m. In addition to the positive refining environment, the key performance drivers include high exports, improved refinery operations and international business expansion.

Strategically, we are progressing with the implementation of “Vision 2025”, which aims to strengthen our core activities and establish a new, material pillar in the renewable energy sector. At the same time, we remain committed to investing in operational excellence and the development of our human capital.

Considerable emphasis has been placed on expanding our operations in international markets, either through growing local footprint or through increasing exports and international trading business. In RES, we are implementing our growth strategy but remain cautious, as challenges related to grid constraints and storage technologies remain unresolved. Nevertheless, we are maturing our portfolio, which currently stands at 4.3 GW, and have visibility to 1 GW being operational within the next 18 months.

In terms of 2Q24 prospects, refining margins, albeit lower compared to 1Q24, are still on positive ground. Domestic market demand remains strong, predominantly for auto-fuels, while the outlook for the tourist season looks promising.”

Key highlights and contribution for each of the main business units in 1Q24 were:

Refining, Supply & Trading

-

Refining, Supply & Trading Adjusted EBITDA came in at €289m, supported by increased sales (+8%) due to improved availability and higher production from the 3 refineries, high refining margins and system overperformance.

-

Production reached 3.8m MT, +5% y-o-y, while contribution of high value-added products in the product mix was maintained above 80%.

Petrochemicals

Marketing

-

Domestic Marketing recorded a 2% increase in sales volume, with improved market shares and greater contribution from premium products for yet another quarter. Aviation sales increased by 21%, while bunkering sales remained stable y-o-y. Profitability improved, supported by inventory valuation gains. However, regulatory constraints on the retail gross margin continue to remain in place.

-

International Marketing recorded improved performance, with increased retail sales, higher market shares and a greater contribution from premium products. Profitability was primarily affected by costs associated with network expansion.

Renewables

-

RES EBITDA amounted to €11m in 1Q24. Power generation remained at the same levels as last year, while the installed capacity increased to 381 MW (+40 MW compared to the corresponding period in the previous year), as at the end of 1Q24 26 MW of PV parks were successfully installed in Cyprus.

Associate companies

-

In 1Q24 the contribution from associate companies, which are consolidated using the equity method, was negative and came in at €-4m, compared with €31m in 1Q23.

-

Elpedison's profitability was adversely affected by the reduced availability of the Thisvi power plant and the decrease in electricity prices in the wholesale market. However, it is worth noting that The Thisvi plant resumed its normal operations earlier than scheduled, towards the end of 1Q24.