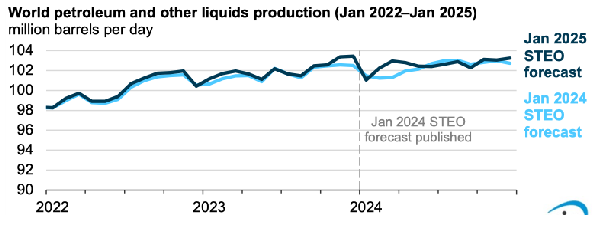

This confirmed a remarkable predictive accuracy. EIA’s forecasts of ‘world petroleum and other liquids’ production in Figure 1 show very close agreement with actual data over the complete period January 2022-January 2024.

Figure 1: World petroleum and other liquids production over the complete period January 2022-January 2024

https://www.eia.gov/todayinenergy/detail.php?id=64304&utm_medium=email

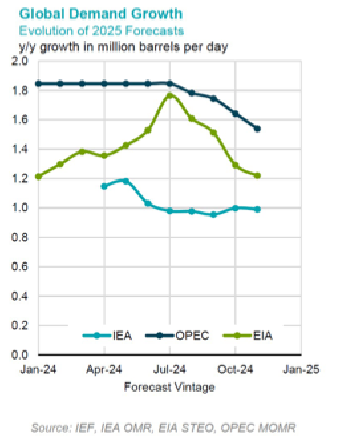

This gives credibility to EIA’s forecasts that appear to be more realistic than those produced by the International Energy Agency (IEA) and OPEC that pull in opposite directions.

The IEA is considered to be biased, producing results underplaying the growth in oil demand in support of energy transition and net-zero by 2050. It has missed its initial estimatefor oil demand growth on the low side in 11 of the past 13 years. During this decade it has been predicting peak oil persistently, but with oil demand expected to continue rising -including this year and next- this is turning out to be a moving target.

As Forbes points out, IEA’s own medium-term forecast to 2030 suggests that oil demand will rise by 3 million barrels per dayby 2030, versus IEA’s Stated Policies Scenario in its latest World Energy Outlook, which sees 2030 oil demand as virtually unchanged from 2023 -plainly not the case.

OPEC is doing the opposite. OPEC is also considered to be biased on the upside, because it has a vested interest in maintaining strong oil production and prices for decades to come.

The difference is that that, unlike the IEA, OPEC is a business organization expected by its members to get forecasts right.

This contrast between the three organizations is evident in Figure 2. Given the results in Figure 1, my money is on the EIA.

Figure 2: Global oil demand growth – evolution of 2025 forecasts

https://www.ief.org/news/comparative-analysis-of-monthly-reports-on-the-oil-market-57

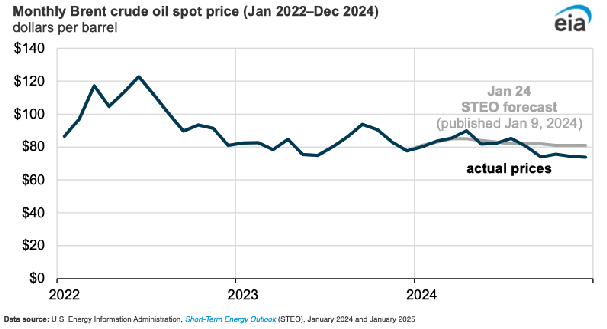

Similarly, EIA’s Brent crude oil spot price forecasts over the last three years follow actual outcomes quite closely (Figure 3).

Figure 3: Monthly Brent crude oil spot price forecasts(Jan 2022- Dec 2024)

https://www.eia.gov/todayinenergy/detail.php?id=64304&utm_medium=email

Since the Covid-19 outbreak the divergence between the EIA, IEA and OPEC forecasts has been increasing, reflecting theiroften-conflicting priorities in the light of climate change pressure. All three publish short and long-term oil outlooks, but given their differing priorities it is difficult to say which provides the most objective forecasts.

However, based on Figures 1 and 3, I would place more credibility on EIA’s forecasts. Or, with IEA’s pessimism compensated by OPEC’s optimism, the average of all three forecasts may be as good a choice as any!

However, 2025 oil production and prices may be affected by greater uncertainty caused by President Trump’s “difficult to predict” new energy policies, especially after his declaration of emergency powers to unleash domestic energy production. The readiness of countries to buy more American oil and gas to appease Trump will also be a factor. “Expect the unexpected” may become the new norm.

*Dr Charles Ellinas, @CharlesEllinas

Councilor

Atlantic Council

21 January, 2025